27-floor structure will have 379 apartments, including 76 subsidized units, and 6,200sf of retail space. The building will feature a pair of outside terraces, dog run, gym, children’s playroom, workspace for artists, lounge and game room. The developer is WBLM 10 Le Count Owner LLC, a partnership of Chappaqua-based Wilder Balter Partners Inc. and Larchmont-based L+M Development Partners. (westfaironline.com)

- Stella, One of the Area’s Most Successful Multifamily Developments, is Fully Leased in 15 Months After its Debut (6/8/2023)

- Stella At 10 LeCount Place In New Rochelle Awarded Best Luxury Multifamily Development (4/20/2023)

- Banner Year for Leasing at Stella and Twenty Five Maple Luxury Rental Properties in Downtown New Rochelle (1/21/2023)

- Banner Year for Leasing at Stella and Twenty Five Maple Luxury Rental Properties in Downtown New Rochelle (1/21/2023)

- LMXD Reveals New Photos Of ‘Stella’ Amenities At 10 Lecount Place In New Rochelle (9/6/2022)

- A Luxe Address For Two- And Four-Legged Creatures (6/13/2022)

- A Cup Of Joe (Coffee) In New Rochelle (6/13/2022)

- NYC chain Joe Coffee coming to New Rochelle this summer (3/28/2022)

- Stella, a New Tower Featuring 380 Residences, is Over 60 Percent Leased in Just Five Months (3/3/2022)

- Stella, a New Tower Featuring 380 Residences, is Over 60 Percent Leased in Just Five Months (3/3/2022)

- Stella gets ready for a stellar opening (11/12/2021)

- 28-Story ‘Stella’ At 10 LeCount Place Debuts Its 380 Residences In New Rochelle, New York (10/21/2021)

- Groundbreaking for 14 Lecount (11/22/2019)

- The Marketing Directors named sales/leasing team for 3 Westchester projects (1/22/2019)

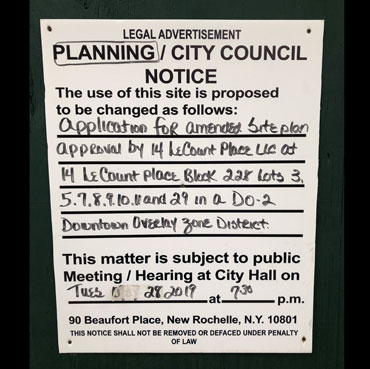

- Affordable Housing Approved for New Rochelle Development (10/5/2018)

- New Rochelle IDA approves $41.7M in tax subsidies, considers another $67.8M (7/12/2018)

- New Rochelle: More affordable housing coming to downtown (6/29/2018)

- Three New High-Rise Projects on Tap in New Rochelle (3/5/2018)

Zone: D0-2

Project Videos HERE

News

- Resolution-Site Plan Approval (4/24/18)

- Resolution-Neg Dec (4/24/18)

- Resolution-Lead Agency (4/24/18)

- NRIDA Agenda Package (5/30/18)

- NRIDA Agenda Package (6/27/18)

- NR IDA Meeting Minutes 6/27/18

- NR IDA Meeting Minutes 5/30/18

- Brownfield Cleanup Information

- NR Planning Meeting video 9/30/20 (starting at 35:30) -- Phase 2

- Web Cam -- Wilder Balter Partners

- Leasing Page

- Stella Fact Sheet November 2021

- Case Study: The Stella, New Rochelle, NY

Project Information

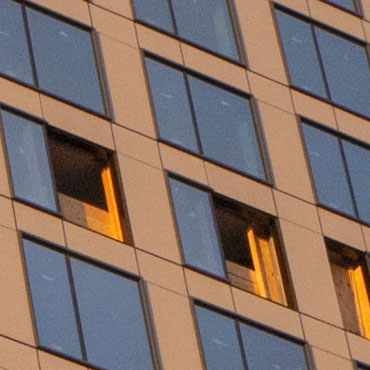

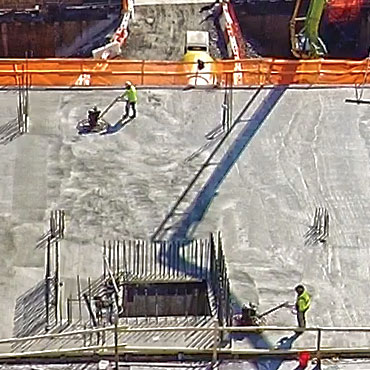

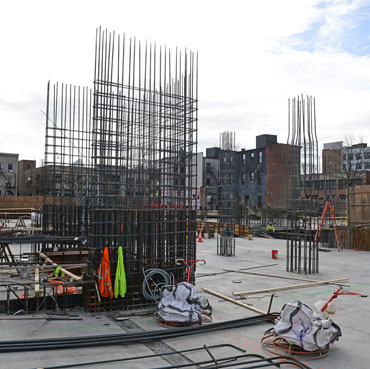

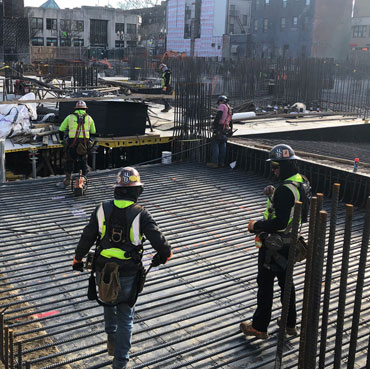

Progress Gallery

Project Data*

Building

Studios: 65

1BR: 155

2BR: 63

3BR: 2

4BR: 0

Affordable: 95

Total: 380

Parking: 169

Stories: 27

Retail Space: 6170 sqft

Occupancy

Students: 15

School: Trinity

Jobs

Permanent FT: 10

Permanent PT: 1

Dates

Planning Board Approval: 4/24/2018

IDA Approval: 5/30/2018

Constr. Start: 9/1/2018

Length: 48

Completion: 9/1/2022

Tax Incentives

Full Property Tax: $32,994,680

PILOT: $20,353,095

Owner Savings: $12,641,585

PILOT (yrs): 30

Mortgage Tax Exemption: $1148000

Fair Share Mitigation: $566,141

Data Last Updated: 1/11/2022

*Data listed here is subject to change. FOIL/FOIA requests are pending to obtain any missing data. Some of these numbers are estimated. Data comes from city documents.

** GLOSSARY TERMS: "As Is" taxes are the taxes of the property before development. Full Property Taxes are the taxes of the property after development. PILOT means Payment in Lieu of Taxes, which is less than full property taxes. Owner savings is the property tax abatement in dollars and as a percent of Full Property Taxes. PILOT length is the number of years that the PILOT is in effect. Fair Share Mitigation (FSM) fees are monies collected by the City from the developer to cover future infrastructure needs. The school system gets approximately 2/3 of the FSM fees.

*** Residents are calculated as follows: Studios = 1, 1BR = 1.5, 2BR = 3, 3BR = 4.5 (NDC formula) Students are calculated as follows: Studios (*0), 1BR (*0.014), 2BR (*0.141), 3BR (*0.213) (NDC formula)

*Data updating and collection is done by volunteers and may contain the occasional error or miscalculation.

** New Rochelle Parking Code including Minimum number of Spaces