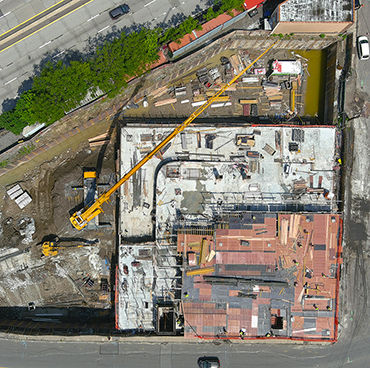

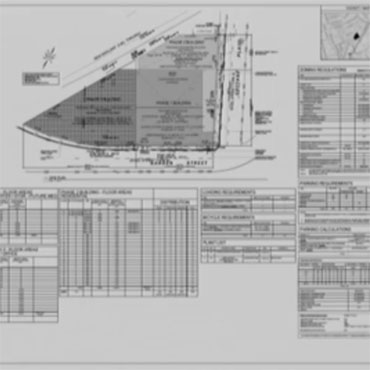

This is a multi-phase project. Phase 1 was completed in the summer of 2021. It is now the Westchester Family Court. The 5-story base contains parking on floors 1 & 2 (231 spaces), two floors of courthouse space and two buffer floors. The 3rd floor contains 2 court rooms, 3 hearing rooms, judge’s chambers with support staff and a terrace. The 4th floor contains support staff and a women’s center. The buffer floor(s) were mandated by the city so that the courthouse could operate during the construction of the residential tower.

Phase 2 is in construction now. It is West View Apartments and will be 24 stories and contain 186 affordable units, reserved for families with incomes at or below 60 percent of the area medium income for Westchester County. (34 studios, 96 one-bedroom and 56 two-bedroom units.) The residential tower will include a community room, gym, computer center, laundry facilities and parking for tenants. It is expected to be completed and rented by July 1st, 2025.

Phase 3 will include an additional mixed-use building with its design detail and planned uses still to be determined.

The project was designed by Newman Architects with BE Bronx Builders as the General Contractor. Simone Development / Stagg

- Simone, Stagg Group Launch Construction on Phase 2 of New Rochelle MXU (8/19/2022)

- Construction Begins On New Affordable Housing Tower In New Rochelle (8/11/2022)

- Simone Development and Stagg Group Commence Construction on 186 Units of Affordable Housing in New Rochelle (8/8/2022)

- NY Awards $80M In Financing To New Rochelle Affordable Development (8/1/2022)

- Simone Development and the Stagg Group to Develop New Westchester Family Court in New Rochelle (7/25/2019)

- New Family Court Location Found In New Rochelle - PATCH (7/16/2019)

- Family Court Will Move to Garden Street (7/16/2019)

- Workforce, luxury development to be steps from New Rochelle train station (11/30/2018)

Zone: D0-2

Project Videos HERE

News

- City-County Lease Agreement

- NR Planning Meeting video 1/28/20 (starting at 4:15)

- IDA Draft Meeting Minutes 2/29/20

- Westchester Board of Legislator meeting minutes 7/12/19

- NR Planning Meeting video 2/25/20 (starting at 54:00)

- Stagg Group

- Planning Meeting, Sep 24, 2024 start at 1:45

Project Information

Progress Gallery

Project Data*

Building

Studios: 34

1BR: 102

2BR: 50

3BR: 0

4BR: 0

Affordable: 186

Total: 186

Parking: 241

Stories: 14

Retail Space: 3000 sqft

Occupancy

Students: 9

School: Columbus

Jobs

Permanent FT: 37

Permanent PT: 5

Dates

Planning Board Approval: 1/28/2020

IDA Approval: 2/20/2020

Constr. Start: 9/1/2019

Length: 50 months

Completion: 12/1/2023

Tax Incentives

Full Property Tax: $26,022,861

PILOT: $4,163,658

Owner Savings: $21,859,203

PILOT (yrs): 30

Mortgage Tax Exemption: $1700000

Fair Share Mitigation: $

Data Last Updated: 10/10/2020

*Data listed here is subject to change. FOIL/FOIA requests are pending to obtain any missing data. Some of these numbers are estimated. Data comes from city documents.

** GLOSSARY TERMS: "As Is" taxes are the taxes of the property before development. Full Property Taxes are the taxes of the property after development. PILOT means Payment in Lieu of Taxes, which is less than full property taxes. Owner savings is the property tax abatement in dollars and as a percent of Full Property Taxes. PILOT length is the number of years that the PILOT is in effect. Fair Share Mitigation (FSM) fees are monies collected by the City from the developer to cover future infrastructure needs. The school system gets approximately 2/3 of the FSM fees.

*** Residents are calculated as follows: Studios = 1, 1BR = 1.5, 2BR = 3, 3BR = 4.5 (NDC formula) Students are calculated as follows: Studios (*0), 1BR (*0.014), 2BR (*0.141), 3BR (*0.213) (NDC formula)

*Data updating and collection is done by volunteers and may contain the occasional error or miscalculation.

** New Rochelle Parking Code including Minimum number of Spaces