7 stories “10 Commerce project, by Manhattan-based BRP Development, will consist of 172 residential units; 117 one-bedrooms and 55 two-bedrooms. It will feature 157 parking spaces on the interior of the first two floors, with living spaces wrapping the garage. An outdoor courtyard will sit in the middle of the third level." LoHud, Developer: Breakthrough Real Estate, Architect: Humphreys & Partners

- An Elegant New 'Motif' Now Adorns The New Rochelle Skyline (4/14/2023)

- An Elegant New 'Motif' Now Adorns The New Rochelle Skyline (4/14/2023)

- Urban developer BRP looks to New Rochelle for $57M suburban project (5/3/2018)

- Downtown Development Rolls Forward (12/22/2017)

- More Developments Slated for Downtown (12/21/2017)

Zone: D0-4

Project Videos HERE

News

- Resolution-Site Plan Approval (12/19/17)

- Resolution-Neg Dec (12/19/17)

- Resolution-Lead Agency (12/19/17)

- NRIDA Agenda Package (3/28/18)

- NRIDA Agenda Package (4/25/18)

- NR IDA Meeting Minutes 10/26/16

- NR IDA Meeting Minutes 12/21/16

- NR IDA Meeting Minutes 3/28/18

- NR IDA Meeting Minutes 4/25/18

- Skycore Builders

- Leasing information

- Humphreys & Partners Architects

- Greystar property link

- BRP Development

Project Information

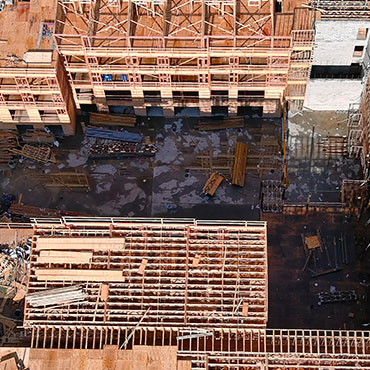

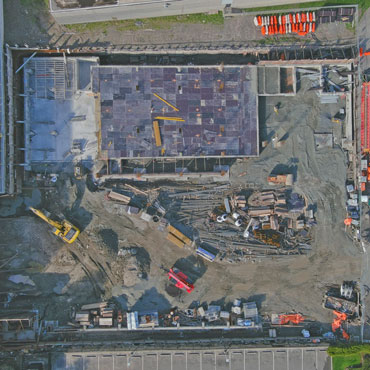

Progress Gallery

Project Data*

Building

Studios: 53

1BR: 64

2BR: 55

3BR: 0

4BR: 0

Affordable: 17

Total: 172

Parking: 162

Stories: 7

Retail Space: 0 sqft

Occupancy

Students: 9

School: Trinity

Jobs

Permanent FT: 6

Permanent PT: 0

Dates

Planning Board Approval: 12/19/2017

IDA Approval: 4/25/2018

Constr. Start: 9/1/2018

Length: 25 months

Completion: 10/1/2020

Tax Incentives

Full Property Tax: $15,776,889

PILOT: $9,573,415

Owner Savings: $6,203,474

PILOT (yrs): 20

Mortgage Tax Exemption: $342511

Fair Share Mitigation: $251,243

Data Last Updated: 11/7/2018

*Data listed here is subject to change. FOIL/FOIA requests are pending to obtain any missing data. Some of these numbers are estimated. Data comes from city documents.

** GLOSSARY TERMS: "As Is" taxes are the taxes of the property before development. Full Property Taxes are the taxes of the property after development. PILOT means Payment in Lieu of Taxes, which is less than full property taxes. Owner savings is the property tax abatement in dollars and as a percent of Full Property Taxes. PILOT length is the number of years that the PILOT is in effect. Fair Share Mitigation (FSM) fees are monies collected by the City from the developer to cover future infrastructure needs. The school system gets approximately 2/3 of the FSM fees.

*** Residents are calculated as follows: Studios = 1, 1BR = 1.5, 2BR = 3, 3BR = 4.5 (NDC formula) Students are calculated as follows: Studios (*0), 1BR (*0.014), 2BR (*0.141), 3BR (*0.213) (NDC formula)

*Data updating and collection is done by volunteers and may contain the occasional error or miscalculation.

** New Rochelle Parking Code including Minimum number of Spaces